The SPEL Semiconductor share price has been a topic of interest for investors and industry enthusiasts alike. As one of India’s leading semiconductor packaging companies, SPEL Semiconductor plays a critical role in the country’s growing semiconductor landscape. For those tracking market trends, understanding the factors influencing the SPEL Semiconductor stock price and related metrics like the SPEL Semiconductor Ltd share value is crucial. Let’s delve into the details and examine the factors shaping this company’s market performance.

Table of Contents

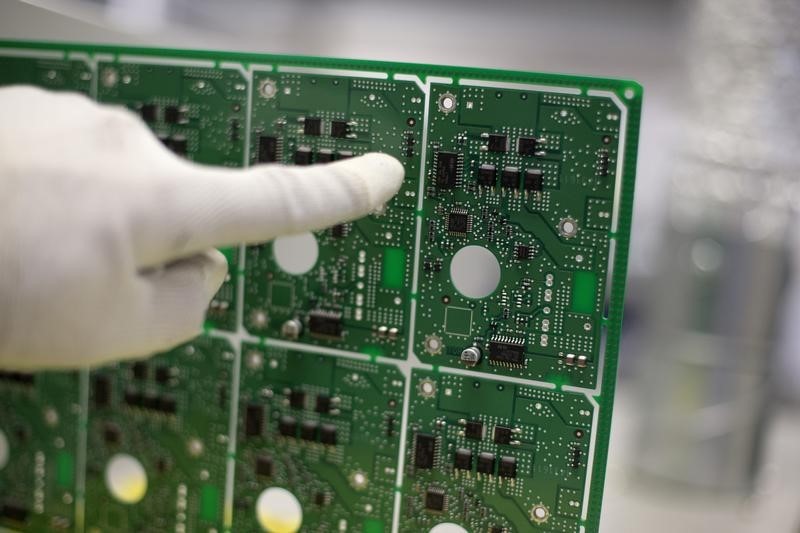

The Role of SPEL Semiconductor in India’s Tech Landscape

SPEL Semiconductor Ltd, headquartered in Chennai, is a pioneer in semiconductor assembly and test services (SATS) in India. With decades of experience, the company caters to global clients across industries, including automotive, consumer electronics, and telecommunications. As India’s semiconductor industry gains traction, SPEL’s positioning as a key player influences its SPEL Semiconductor stock performance and market perception.

Recent Trends in SPEL Semiconductor Share Price

Over the past year, the SPEL Semiconductor share price has exhibited notable fluctuations. Several factors have contributed to this:

- Global Semiconductor Demand: The ongoing chip shortage has created a ripple effect across the semiconductor value chain, impacting companies like SPEL.

- Government Policies: India’s semiconductor mission and initiatives to promote local manufacturing have positively influenced investor sentiment around SPEL.

- Earnings Reports: Quarterly earnings, profitability metrics, and revenue growth play a vital role in shaping the SPEL Semiconductor stock price.

- Market Sentiment: Broader market conditions, including interest rates and foreign investment flows, also affect the SPEL Semiconductor Ltd share value.

Key Statistics at a Glance

- Market Capitalization: SPEL’s market cap highlights its role as a mid-cap player in the Indian tech ecosystem.

- Recent Highs and Lows: Monitoring the 52-week high and low prices can offer insights into the stock’s volatility and investor confidence.

- Dividend History: Investors often look at dividend payouts as a signal of financial health.

Factors Impacting SPEL Semiconductor Stock Performance

Several internal and external factors influence the SPEL Semiconductor stock performance:

- Technological Advancements: SPEL’s ability to adopt cutting-edge technology and deliver high-quality services ensures it remains competitive.

- Global Collaborations: Partnerships with international semiconductor giants can enhance SPEL’s market reach and credibility.

- Economic Trends: Macro-economic conditions, including GDP growth and currency fluctuations, indirectly affect the SPEL Semiconductor share price.

- Competitor Activity: The performance of other semiconductor companies in India and abroad also shapes market sentiment toward SPEL.

How Investors Can Track SPEL Semiconductor Share Price

Investors looking to stay informed about the SPEL Semiconductor stock price should consider the following:

- Market Analysis Tools: Platforms like NSE and BSE provide real-time updates on the SPEL Semiconductor Ltd share value.

- Company Announcements: Regular updates from SPEL regarding projects, investments, or earnings are key indicators of future stock trends.

- Analyst Reports: Expert opinions can offer valuable insights into the stock’s potential performance.

A Bright Future for SPEL Semiconductor

India’s semiconductor ambitions place companies like SPEL in a favorable position. As the government ramps up investments in semiconductor infrastructure and policy support, the SPEL Semiconductor share price is likely to reflect these positive developments. Furthermore, the company’s consistent focus on innovation and customer satisfaction ensures its SPEL Semiconductor stock performance remains resilient amid global challenges.

Tips for Potential Investors

- Research Thoroughly: Analyze historical trends of the SPEL Semiconductor Ltd share value to make informed decisions.

- Diversify Investments: While SPEL offers growth potential, diversifying your portfolio minimizes risks.

- Stay Updated: Keep an eye on industry news, government policies, and SPEL’s corporate updates to understand factors influencing the SPEL Semiconductor share price.

With the semiconductor industry poised for exponential growth, SPEL Semiconductor is well-positioned to leverage its expertise and market presence. For investors and industry watchers, tracking the SPEL Semiconductor stock price, SPEL Semiconductor Ltd share value, and SPEL Semiconductor stock performance offers valuable insights into the evolving dynamics of India’s semiconductor ecosystem. Read more stories like this on Tech Scoop India.